Publications

Finacity facilitates daily funding and reporting at an annual run rate of over $200 billion in receivables with obligors in more than 210 countries and territories

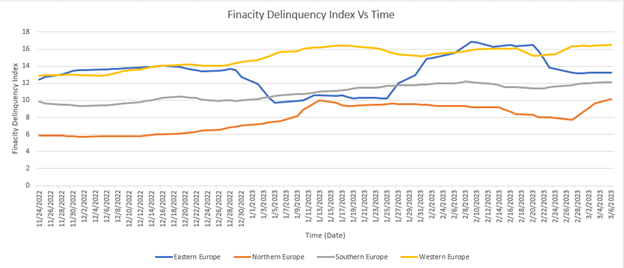

inVOICES: Regional Differences in Delinquencies in Europe

May, 2023 by FinacityinVOICESTM

With its global reach in receivables financing, Finacity is in constant contact with active participants in all stages of the receivables market, from originators to funding sources. Moreover, Finacity manages a massive, near-real-time database of receivables data, including over 60 million annual transactions, covering 4 million buyers and sellers in 175 countries – over $150 billion in annual trade in 58 currencies. Between this knowledge base, other external data sources, and its professional experience and expertise, Finacity is in a unique position to deeply understand how receivables behave; how they are affected by global events; what trends may be developing in receivables performance or the global economy; and how to leverage such insights to improve performance and/or other financial outcomes. Many of the observations and analyses Finacity provides to its clients are by their nature confidential and specific to the client in question. In this series, we explore some observations that are not based on specific client data, and can be shared more broadly.

ABSTRACT

A number of global factors have had an effect on the European economy and receivables performance in the last several years, from COVID-19, to the war in Ukraine, to supply chain issues, to inflation. While many of these factors are global in nature and have affected Europe as a whole, the impact has not always been uniform across the continent. For example, one might expect the war in Ukraine to affect the regions of Europe differently. In this paper we examine receivables delinquency patterns across four regions of Europe in late 2022, and note trends, similarities and differences.

METHODOLOGY

Finacity aggregates data from a large number of public and private sources, and has created proprietary techniques and metrics to integrate receivables performance information and identify macro trends at the country, currency, and industry level. In this case, we track Finacity’s delinquency metric from November 2022 to March 2023 in four regions: Eastern Europe, Northern Europe, Southern Europe, and Western Europe.

RESULTS

Second, noting the trend over this time frame, delinquency increased in all regions, suggesting global (or at least, pan-European) stresses on obligors generally.

Regarding global factors that may have had an influence on receivables performance, we note: continuing inflation, higher interest rates, slower growth and persistent recession fears, weakening European currencies, lingering COVID-19 effects, and the war in Ukraine. The war could well be the primary differentiator with respect to the greater variability in Eastern Europe’s receivable performance.

SUMMARY: GLOBAL ECONOMIC INSIGHTS IN REAL-TIME FROM RECEIVABLES DATA

Trade receivables information allows for quick identification of real-time trends in the economy. Most worldwide trade activity is conducted through trade receivables, which therefore immediately reflect changes in economic activity. Examination of receivables can shed light on which factors are, and are not, contributing most to the reshaping of the economy. Please continue to monitor inVOICESTM as we listen to what receivables are telling us about the global economy.

Click to Download Original PDF

AUTHORS

Jeremy Blatt

jblatt@wofinacity.com

Managing Director

Michael Johnson

mjohnson@wofinacity.com

Senior Client Success Analyst

Arjay Mirchandani

amirchandani@wofinacity.com

Onboarding Analyst

Ileana Palesi

ipalesi@wofinacity.com

Software Developer II

Andreas Rothbauer

arothbauer@wofinacity.com

Senior Director

Finacity Corporation

263 Tresser Blvd., 10th Floor

Stamford, CT 06901