Publications

Finacity facilitates daily funding and reporting at an annual run rate of over $100 billion in receivables with obligors in more than 175 countries

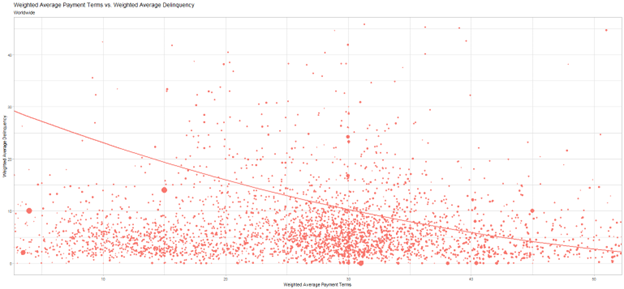

inVOICES: Weak Inverse Correlation between Payment Terms and Delinquency

Dec, 2023 by FinacityinVOICESTM

With its global reach in receivables financing, Finacity is in constant contact with active participants in all stages of the receivables market, from originators to funding sources. Moreover, Finacity manages a massive, near-real-time database of receivables data, including over 60 million annual transactions, covering 4 million buyers and sellers in 175 countries – over $200 billion in annual trade in 58 currencies. Between this knowledge base, external data sources, and its professional experience and expertise, Finacity is in a unique position to deeply understand how receivables behave; how they are affected by global events; what trends may be developing in receivables performance or the global economy; and how to leverage such insights to improve performance and/or other financial outcomes. Many of the observations and analyses Finacity provides to its clients are by their nature confidential and specific to the client in question. In this series, we explore some observations that are based on general market data that can be shared more broadly.

ABSTRACT

There are many factors that influence the time it takes a buyer to pay a seller, and most sellers would be keenly interested in shortening that time span. Most of these factors are outside the seller’s control (the buyer’s specific financial situation, or the economic backdrop, e.g.), but payment terms are among the few within the seller’s control. So, it would be important to know how, and to what extent, payment terms are related to delinquency. Our analysis suggests that there is indeed a statistically significant correlation, although it is rather weak – meaning that there is strong evidence that some correlation exists, but that any influence payment terms and delinquency may have on each other is small. This lends support to the possibility that changing payment terms may at least somewhat affect delinquencies, though it also supports the notion that many larger factors outside the seller’s control have greater influence on delinquencies.

METHODOLOGY

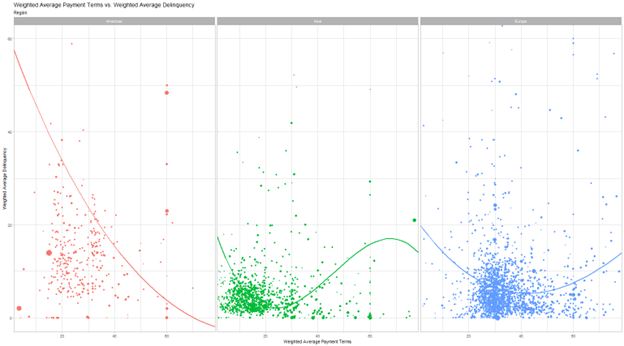

Finacity aggregates data from a large number of public and private sources; and has created proprietary techniques and metrics to integrate receivables performance information and identify macro trends and buyer behaviors at the country, currency, and industry level. In this case, we examined over 16 million invoices raised between [November 2022] and [March 2023] across the globe and across a variety of industries, and assessed the correlation between Weighted Average Payment Terms and [Weighted Average Delinquency], both at the global and continental levels.

RESULTS

Generally, this inverse correlation makes intuitive sense: lengthy terms give a buyer little excuse to pay significantly late, while practical considerations may make very short terms challenging even for well-intentioned buyers, who may be forced to ignore them and pay well past the due date. Note that the graph is “zoomed in” and doesn’t show the entire data set; in particular, there are enough data points with very short payment terms and very high delinquencies to make the curve a good fit despite it appearing to be well above the short payment terms data points.

Note that there are challenges drawing conclusions about causation from statistical correlation. While it is reasonable to surmise that changing payment terms can lead to a change in delinquency, it remains possible that causation works in another direction. For example, that payment terms are mostly dictated by largely external economic factors that are also correlated with delinquencies.

[1] The best polynomial fit is a cubic curve with an R2-value of 8.5%, and a p-value less than 0.005.

All three regions exhibit similar behavior when payment terms are small (the left sides of the graphs) – delinquencies increase as payment terms approach zero (the curves climb as they approach the left ends). This suggests that the practical reality of very short payment terms often being challenging is a consistent factor that dominates regional differences. Behavior when payment terms are long (the right sides of the graphs), however, varies considerably, with delinquencies declining in the Americas, increasing in Europe, and increasing followed by a decline in Asia, as payment terms get longer (as the curve approaches the right end). This suggests that the regional differences are more relevant to longer-term receivables and that they do not have similar effects on delinquencies at longer terms of sale.

[2] The curves shown are best-fit polynomials, with R2-values 15.09%, 7.32%, and 56.02%, respectively. All p-values are much smaller than 0.005.

SUMMARY: PAYMENT TERMS AND DELINQUENCIES ARE INVERSELY CORRELATED

Trade receivables information allows for many insights into the behavior of buyers and sellers across industries, countries, and currencies. Most worldwide trade activity is conducted through trade receivables, so such insights give us a view into how the global economy functions. Examination of receivables can shed light on which factors are, and are not, contributing most to the ongoing evolution of the economy. In this article, we showed that payment terms are inversely (albeit weakly) correlated with delinquencies. Please continue to monitor inVOICESTM as we listen to what receivables are telling us about the global economy.

Click to Download Original PDF

AUTHORS

Jeremy Blatt

jblatt@wofinacity.com

Managing Director

Michael Johnson

mjohnson@wofinacity.com

Senior Client Success Analyst

Arjay Mirchandani

amirchandani@wofinacity.com

Onboarding Analyst

Ileana Palesi

ipalesi@wofinacity.com

Software Developer II

Andreas Rothbauer

arothbauer@wofinacity.com

Senior Director

Finacity Corporation

263 Tresser Blvd., 10th Floor

Stamford, CT 06901