What We Do

OUR WORK

Our services can include but are not limited to: analyzing clients’ receivables portfolios, finding a suitable funding partner, structuring the transaction to meet rating agency criteria and lender requirements, acting as back-up servicer for the transaction and producing daily, weekly and/or monthly reports on an ongoing basis.

Through our expertise and experience, Finacity can help navigate difficult transactional aspects such as non-OECD obligor countries, difficult or complex jurisdictions, achieving true-sale and off-balance sheet treatment, obtaining trade credit insurance and funding in multiple currencies.

Finacity also offers other working capital solutions, including factoring, asset-backed loans and forfaiting. Finacity also has the ability to leverage our existing securitization platform to provide unique financing solutions in both payables auction management and supply receivables purchase facilities.

Headquartered in Stamford, Connecticut, Finacity services clients in North America, Latin America, Europe, the Middle East, Africa, and Asia.

Finacity’s clients range from large multi-national shipping companies to micro-finance loan branches in Latin America. Our clients have credit ratings from Caa3 to investment grade, with annual revenues from $50 million to over $120 billion across a multitude of industries and locations around the world.

SECURITIZATION PROCESS

Securitization is a mechanism for companies to raise capital against portfolios of specific receivables on a non-recourse basis. Transactions typically involve a one-off or periodic legal true sale of the receivables to a Special Purpose Vehicle (“SPV”). The SPV, in turn, raises funds for a portion of the total value of the receivables, using the receivables as collateral. The seller receives the proceeds raised by the SPV initially, with the balance payable as the receivables collect.

Calculating The Advance Rate

Step 1

Transactions are typically structured to the equivalent of a high investment grade rating using methodologies recommended by the major rating agencies. The objective is to use the rating agency methodology to arrive at an advance amount or “borrowing base” for the program, taking into account the characteristics of the receivables portfolio.

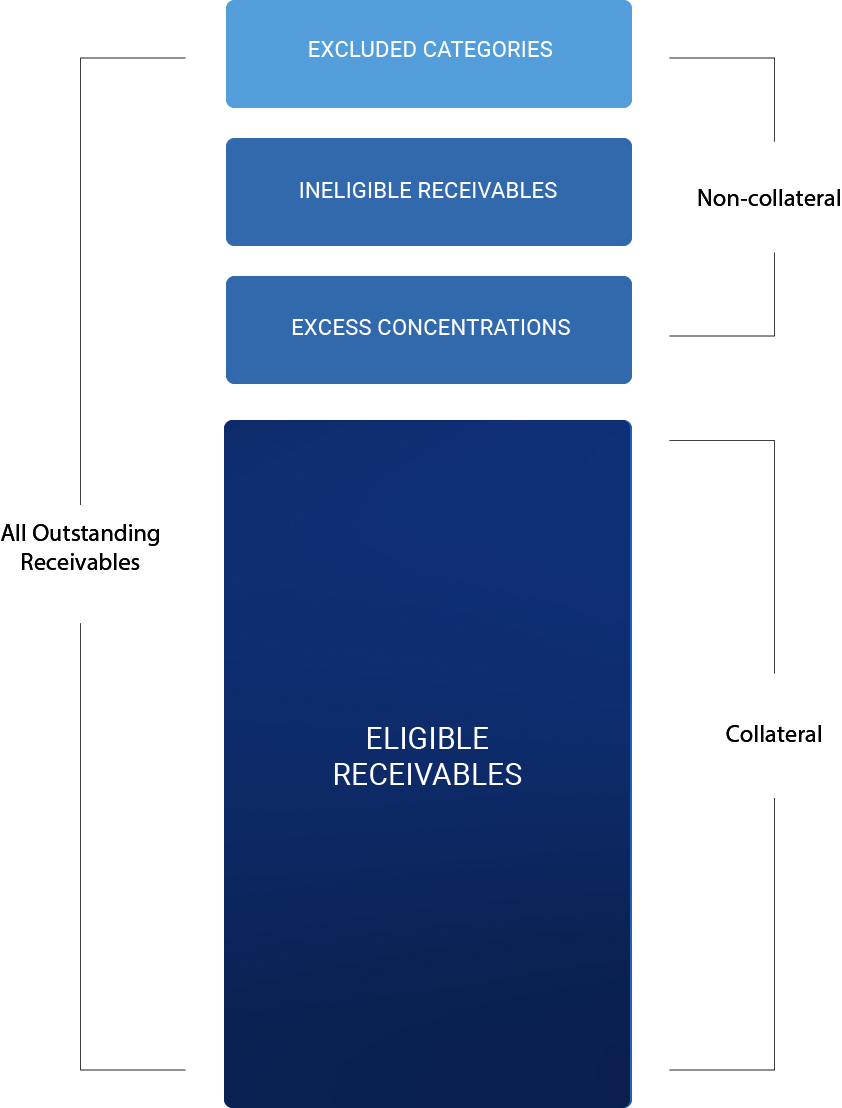

First, the securitization process involves the “filtering” of a receivables portfolio through a series of eligibility criteria and concentration limits to determine which receivables are eligible for funding through the program.

Those receivables that fall outside the eligibility criteria and agreed concentration limits are deemed “non-collateral” and are not given credit in the borrowing base.

Calculating The Advance Rate

Step 2

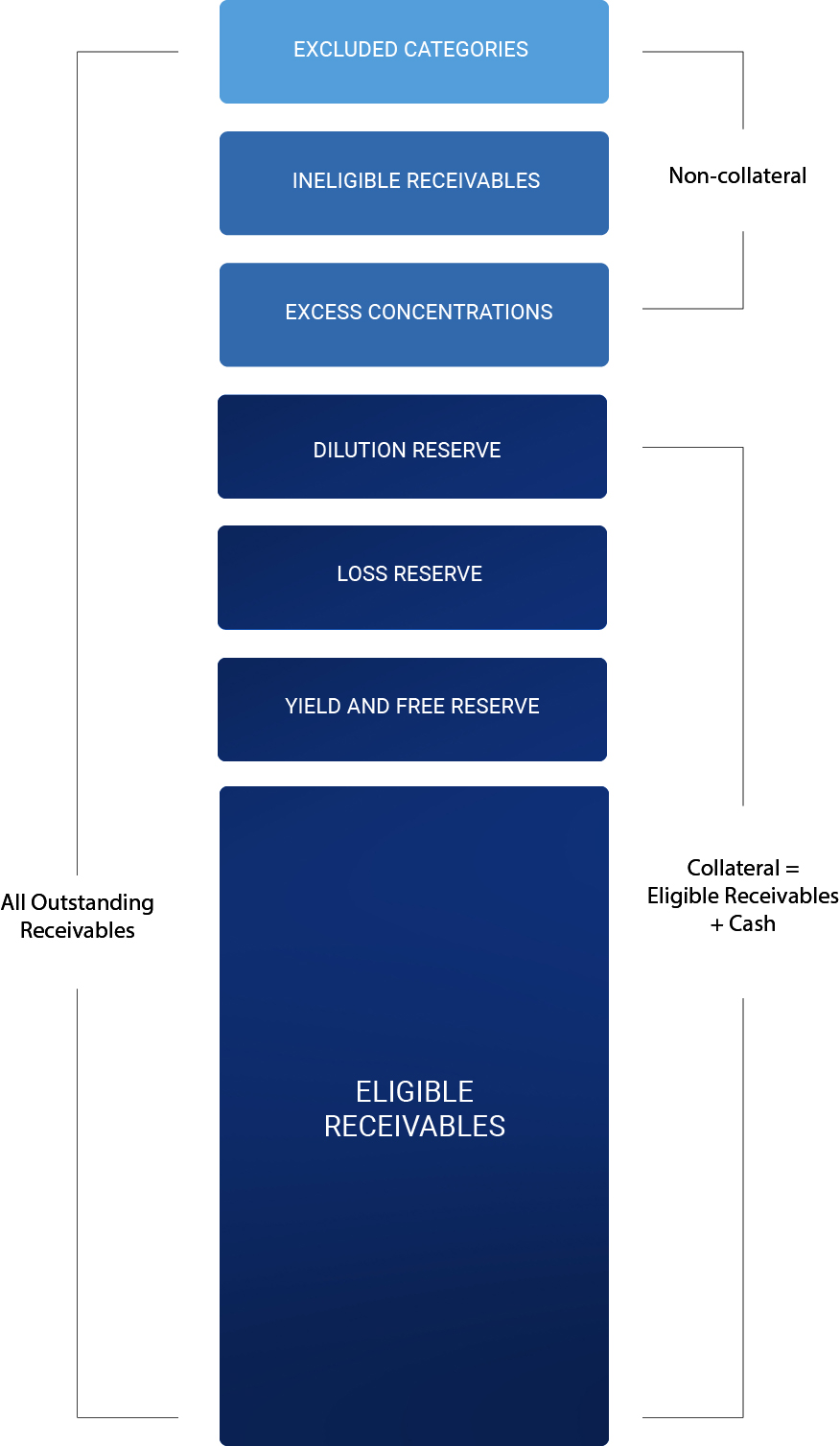

After determining the amount of Eligible Receivables in the portfolio, rating agency methodology is used to calculate the advance amount, or borrowing base. To arrive at an investment grade equivalent rating, the methodology requires that specific amounts of Eligible Receivables are reserved to take into account the specific characteristics of the portfolio.

First, a Dilution Reserve is calculated based on historic dilution, or non-cash reductions in the portfolio e.g. credit notes. Second, a Loss Reserve is calculated based on the historic aging and losses in the portfolio. Finally, a Yield and Fee Reserve is calculated to ensure that yield and fees would be covered in any amortization of the transaction.

Alternative Commercial

Finance Solutions

In some cases, a trade receivable securitization might not be the optimal solution given the size of the receivables portfolio, a small number of obligors, significant obligor concentrations, long receivable tenors, or a need to finance inventory positions in addition to receivables. In these instances, Finacity might propose a working capital solution other than a securitization.

Finacity can assist in arranging a wide variety of alternative

liquidity strategies, including:

- Portfolio factoring (with or without recourse)

- Single obligor receivables purchase facilities

- Supply financing facilities

- Payables auction management

- Asset-based loans

- Secured pre-export/structured trade finance facilities

- Forfaiting

Finacity works closely with our clients to determine the most appropriate financing structure to best meet their needs and to identify the most competitive funding source for each facility.

Finacity has close working relationships with hundreds of bank and non-bank working capital providers around the globe, giving us the ability to structure and negotiate the most efficient and cost-effective funding solutions for each of our clients.

We can also use our securitization platform as a unique SOC-1 compliant reporting solution for working capital facilities. Visit our servicing/reporting page to find out more about Finacity’s reporting capabilities and benefits.

Consumer and Alternative Asset Financing Solutions

Finacity also specializes in achieving funding solutions for consumer and alternative asset classes. These custom designed transactions vary in size and are effective in the financing of a wide range of asset classes, including:

- Auto loans, leases and dealer financing

- Revolving consumer receivables

- Retail and marketplace lender installment loans

- Merchant Cash Advance contracts

- Distressed receivables

- Sovereign and municipal receivables

- Long-term contracts

- Specialty finance assets of all types

Finacity works with funding sources around the globe and is committed to developing the most appropriate and cost-efficient structures to meet our clients’ needs. A consumer or alternative asset finance solution with Finacity

- Solve liquidity needs

- Provide a lower all-in cost of funds

- Address restrictive operating and financial covenants

- Provide funding diversification

- Mitigate asset concentration risk

- Under certain circumstances, provide an off-balance sheet solution

- Long-term contracts

- Specialty finance assets of all types

Finacity is ready to use its unique reporting platform for consumer and exotic deals, providing the best in periodic administrative reporting services for investors and clients. Please visit our servicing/reporting page to find out more about Finacity’s reporting capabilities and benefits.

Deal Structuring

Finacity structures the most cost-efficient securitization program possible, given a client’s objectives. We then solicit bids from several appropriate funding sources in order to obtain the lowest cost of capital, and to expand the client’s network of funding options. If a client so desires, we may also explore alternative funding options for receivables or other asset classes that fall outside the scope of the securitization itself. As a third-party, Finacity is able to preserve its clients’ banking relationships while evaluating funding sources outside of those existing relationships.

When appropriate, Finacity structures a program that includes a proprietary trade credit insurance policy developed in collaboration with trade credit insurance partners. This increases liquidity by allowing advances against certain foreign receivables and weaker credits that would otherwise be ineligible or excluded from the securitization program altogether. The policy is also employed in some cases to solve the issue of customer concentration.

When required by the funding source, Finacity structures a program that conforms to rating agency requirements, and manages the rating process on behalf of the client.

Program Management

Operationally, Finacity independently tracks a client’s accounts receivable portfolio on a daily basis. Our multi-currency and multi-lingual platform accepts data from virtually any accounts receivable system, and can combine receivables from multiple divisions, business units, or locations.

The detailed receivable-level analysis performed by Finacity includes verification of suspicious or unusual items, calculations for daily collateral valuation, reserve maintenance, receivable purchases and payment of fees and interest. We also generate all required daily, weekly, monthly, quarterly and ad-hoc reports, manage cash disbursals to all parties, monitor termination triggers and track the historical basis for reserve percentage adjustments.

Program Administration

Finacity offers a full range of accounts receivable reporting and administration options, including invoice verification and fraud detection, dispute resolution, and customized reporting. Our best-of-breed reporting platform and experienced professionals allow our clients to improve their operational efficiency and accounts receivable portfolio quality at a fraction of the cost of maintaining an internal securitization reporting platform.

SOC-1 Compliant Reporting

Finacity works with our clients and lenders to create custom reports tailored to the individual needs of each party. These detailed reports allow for close monitoring of the accounts receivable portfolio on a monthly, weekly and daily basis. On a daily basis, Finacity tracks changes to the underlying collateral of the receivables, including new receivables raised, collections received by the client and credit or debit adjustments to the outstanding receivables. Our reporting allows us to enforce all deal requirements at an item level to ensure compliance with the rating agency and lender. As a consequence, a Finacity transaction typically provides more financing and better terms for the client.

Daily Reports

Daily reports contain key summary activity necessary to gain insight into the status of the receivables pool, as well as any deal statistics that require frequent monitoring. These reports give a daily snapshot of the receivables pool, as well as monitor the collateral level of the program. The daily reports allow for funds to be swept to our clients on a daily basis.

Weekly Reports

Weekly reports provide statistics on each individual factor that impacts the collateralization of the receivables pool. This allows the client to understand and react to receivables, performance issues, and take corrective action, thereby increasing liquidity.

Ease of Administration

Finacity’s extensive structuring and reporting capabilities minimize

upfront and ongoing transactions administration.

Monthly Reports

Monthly reports summarize all aspects of deal activity that occur during the course of the month. The standard monthly report template includes invoices generated during the calculation period, cash payments made by the obligors, obligor concentration data, aging data, note activity, reserve and deal trigger calculations, fees paid, cash activity and insurance information if applicable. The reports can be customized to include any additional information required by the client or lender.

ESMA Reports

ESMA reports were enacted as a requirement by the European Union in December 2017 in an effort to establish a capital markets union and a single market for investment services and activities. Later in 2020, two technical standards on disclosure requirements under the Securitisation Regulation were published, including standardized templates for making available the information and details of a securitisation by the originator, sponsor, and SSPE. Through Finacity’s detailed transaction reporting, we are well equipped to assist both the client and lender with their respective ESMA reporting requirements.

Risk Mitigation

Finacity’s risk mitigation services employ a combination of data mining, research and predictive modeling to provide insight into the risk profile of an accounts receivable portfolio, as well as early warning of declining receivables performance by obligor, location, or division. We also provide customized reports along with our ongoing reporting that give insight to help our clients better understand their receivables performance.

Back-Up Servicing (Alternate Collection Agent)

Finacity’s detailed analysis and reporting provides funding sources with greater comfort and insight on their investments. Our robust platform and daily tracking puts us in an ideal position to serve as back-up servicer. We currently provide explicit back-up servicing for over $92 billion in annual trade receivables, representing almost half of our $200 billion annual receivables flow.

By nature of our reporting processes, Finacity is already positioned to be a “cold” back-up servicer for most transactions. Our partners provide call center infrastructure, reprographics support, local human capital, and linguistic and tactical assets, as required.

Finacity can act in three different back-up servicing positions: cold, warm, and hot. Depending on lender requirements, Finacity will typically be on standby in a “cold” position, ready to shift to the “warm” or “hot” position or full back-up servicing activation. Through each phase, Finacity is prepared to put the proper procedures in place and reserve the human capital solutions and call center infrastructure, as needed.